Not known Incorrect Statements About Alfa Insurance - Jonathan Portillo Agency

Several company and also personal lines clients won't desire to consider transforming insurance coverage representatives up until their yearly policy renewal, unless they are experiencing a service problem. The insurance coverage licenses you require to run an independent company differ relying on your state. All states have different groups for these licenses as well as their very own particular needs.

Over time, make certain your company can service its existing clients. In the insurance coverage market, holding onto clients is known as "retention." Effective insurance policy companies have a retention rate of 90% or even more. For property/casualty insurance agencies, retention is a meaningful objective since the commissions are recurring. Certainly, brand-new sales are crucial to enable the agency to thrive.

Facts About Alfa Insurance - Jonathan Portillo Agency Uncovered

Independent insurance agents make a standard of 10% to 12% in payment per insurance coverage plan they offer. To receive plan discount rates for the customer, many independent insurance policy representatives try to "pack" auto as well as house insurance plans with the exact same insurance firm.

If you have any kind of inquiries, the Big "I" is standing by to assist you.

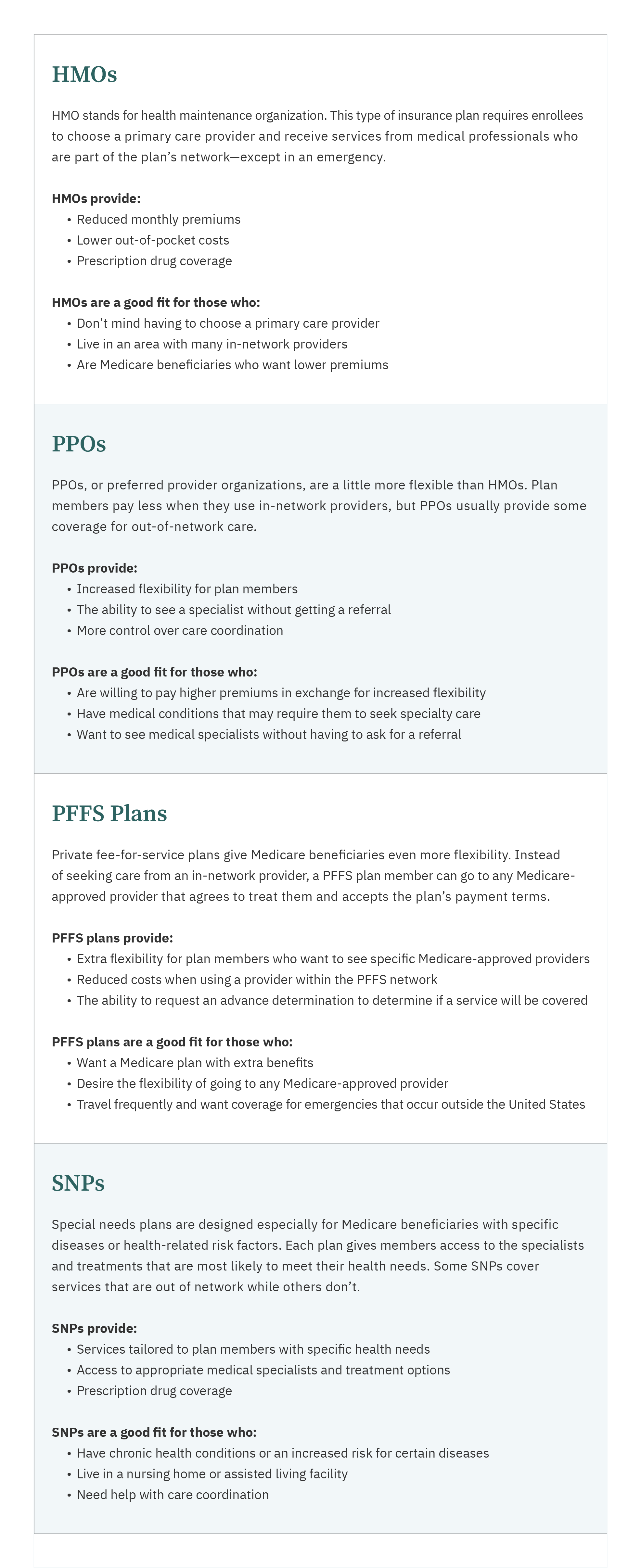

Insurance policy brokers do a plethora of tasks for individuals and services searching for the best insurance policy for them. When you contact an insurance broker for a quote, he will certainly obtain some information and analyze your specific requirements (https://triberr.com/jonfromalfa1). An insurance broker will certainly compare the insurance coverage of various insurance providers to obtain you the most effective conditions as well as prices.

As brokers do not help the insurer, their recommendations are objective as well as in support of the insurance purchaser. Insurance policy can be an intricate concept that is not always understandable. While we understand that we need insurance to safeguard our health and wellness, our home as well as automobile, as well as to guarantee that our loved ones are secured, the better information frequently end up being blurred.

The 6-Minute Rule for Alfa Insurance - Jonathan Portillo Agency

An agent serves as a conduit to give details to insurance buyers. The insurance policy purchaser then has the alternative to select from available policies as well as contracts from the insurance company provided via the representative. These policies and contracts are chosen with contractual contracts that the insurance agents have with the insurers to meet certain guidelines.

However, this does not suggest that the representative has access to all of the supplier's policies. As insurance coverage agents represent insurers, they may or may not have the experience as well as proficiency called for to encourage you regarding the ideal policy for your certain circumstance. While independent insurance agents might have the ability to provide you much more choices as they work with firms that are competing for your company, they usually just offer the insurance choices that will certainly provide them with the most significant earnings.

When buying insurance coverage, there are several essential points you could try these out that consumers look at, including expense, rate, simplicity, safety of individual information, as well as comfort that all essentials are covered. Dealing with an insurance broker can help get you the insurance coverage you require at the ideal price. Brokers handle a large array of product or services and have the credentials required to suggest the plans that finest fit your requirements.

Getting The Alfa Insurance - Jonathan Portillo Agency To Work

This enables you to make an extra enlightened selection when buying insurance coverage. You have actually most likely come throughout broker agent firms when shopping for insurance. Numerous purchasers like functioning with these companies as the majority of have actually developed track records with team that supply the experiences and resources you need to make an informed decision.

When you get in touch with BBG regarding our company insurance coverage solutions, we will certainly figure out the ideal prepare for you according to the demands of your organization, the variety of staff you have, threats that you might be encountering, as well as similar elements. Call our office today to find out more concerning just how we can secure your service or request a consultation online.

Local independent insurance representatives are generally offered only throughout office hours. Insurance Agent in Jefferson GA. This makes sense given that independent companies are usually small organizations that can't have a person manning the phones day-and-night. What that implies for you, however, is that if something occurs with your insurance after-hours or on the weekend break, you're on your very own.